We help you select the investment strategy that’s right for your long-term performance needs, risk tolerance, and investment time horizon.

Our experienced and credentialed investment team continually monitors our client portfolios using current market research and analytical techniques.

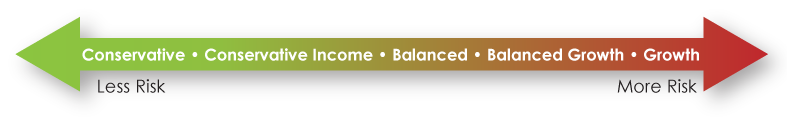

We believe the stock market can be a great source for growth and a hedge against inflation. We also realize it can cause tremendous risk to your financial well-being, which is why our investment team focuses on the risk and reward relationship in order to find the appropriate avenues to invest your money. We are sensitive to our investor's risk tolerance and have developed strategies ranging from conservative to aggressive. Your accounts are closely monitored, and adjustments are communicated to you through monthly custodial statements and personal annual or bi-annual reviews.

Our Investment Strategies Include:

- Conservative (Lowest risk) - Primarily focused on capital preservation

- Conservative Income (Lower risk) - Provides current income and focuses on reducing short-term loss

- Balanced (Medium risk) - Leans toward current income with a secondary focus on capital appreciation

- Balanced Growth (Medium risk) - Leans toward capital appreciation with a secondary focus on current income

- Growth (Higher risk) - Primarily focused on long-term gain