Monthly Market Update: Period Ending

August 31, 2025

Market and Economic Commentary

Friday, August 1st, although the last trading day of a typical week, instilled a sour taste in the mouths of many investors for the upcoming new month. Payroll numbers came out much lower than expected. Construction spending dropped 0.4% when analysts predicted a 0.1% increase. The Institute for Supply Management’s Manufacturing Index fell further into contractionary territory. And the University of Michigan’s Final Consumer Sentiment report for July missed expectations as well. The economic calendar communicated all that data to investors on August 1st – not a great way to start a fresh month. Nevertheless, both equity markets and (most) bond markets ended higher by the end of August (see below).

As the month progressed, there were, of course, some more negative data points, but also more than a few positive reports as well. Gross Domestic Product (GDP), for analysts’ second estimate, boasted a 3.3% expansion for the second quarter, a much stronger showing than the prior estimate’s 3.0% growth in GDP. Productivity and unit labor costs also surprised to the upside. Because of the Federal Reserve’s reluctance to lower rates below the 4.25% and 4.50% range, where it has sat all year, the housing market remains under stress, yet housing starts and existing home sales have shown resilience by outpacing expectations. Looking ahead, market participants will be paying close attention to signals from the Federal Reserve and the timing and extent of cuts to the federal funds rate.

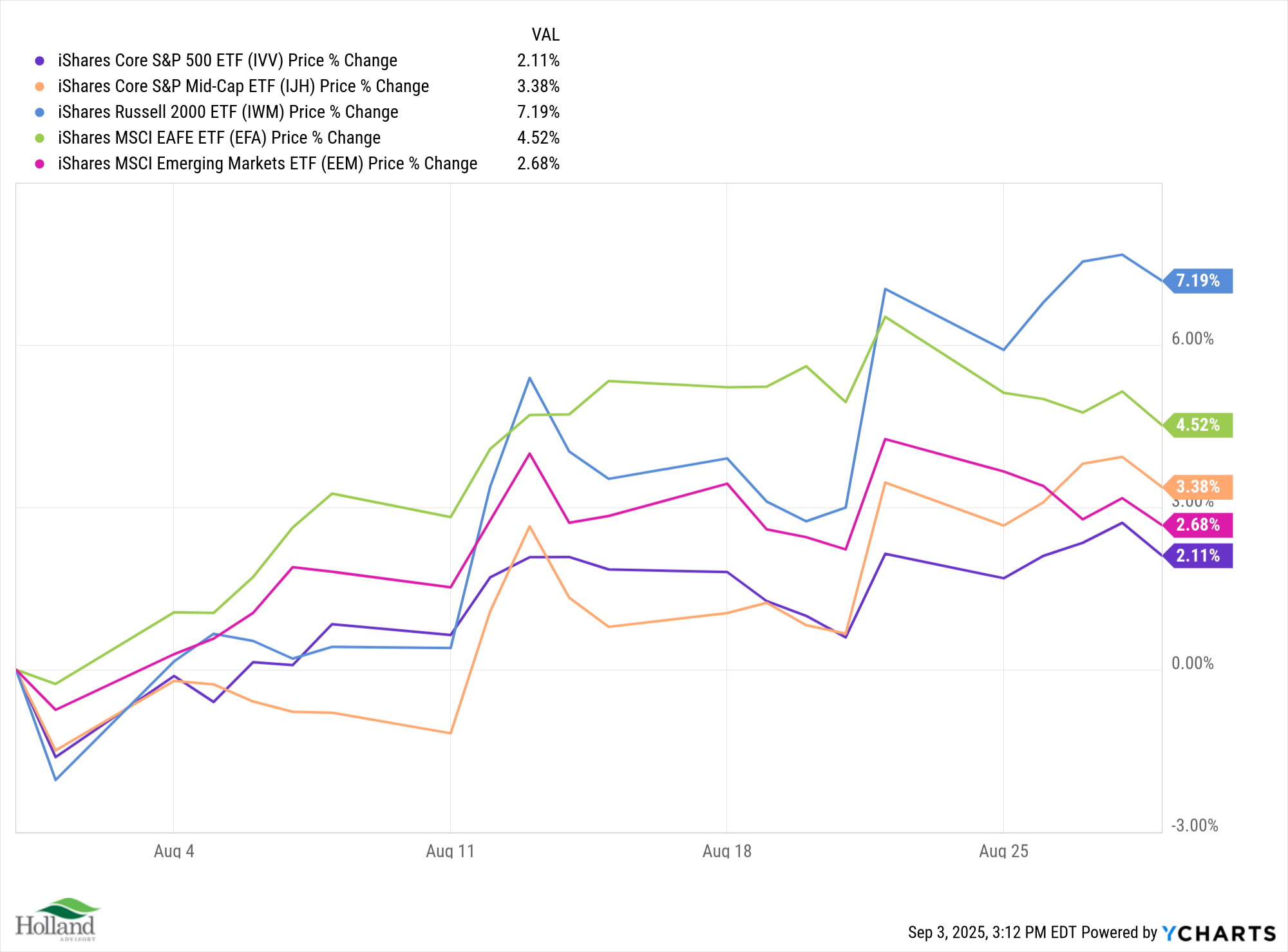

Equities

During the month of August, U.S. large-cap stocks took a backseat on the ride to higher valuations for equity markets worldwide. Despite sitting in the rear, companies whose total value of their outstanding shares equals $10 billion or more (large-caps) still accelerated 2.11%. Mid-caps, companies worth between $2 and $10 billion, advanced a healthy 3.38%. The stars of the month were the small-caps, stocks valued between $250 million and $2 billion – they soared an impressive 7.19%. Investors should keep in mind that although small-cap stocks have the potential for outsized returns, volatility stands as a reminder of the downsides to smaller capitalized stocks.

Returns were not too shabby overseas, as well. Non-U.S. developed equity markets muscled 4.52% higher, while emerging markets chalked up a 2.68% gain. Looking at the value versus growth story, value-leaning equities rose more than their growth counterparts across all size classes. As we review the eleven economic sectors, only Utilities (-1.58%) and Technology (-0.11%) slipped into the negative. The top performer was the Communications sector (formerly known as Telecommunications), boasting an over 11% return in only a single month. For a useful comparison, the second-best performing sector was Healthcare with a 5.37% surge, impressive by any means, but less than half the return accomplished by companies within the Communications sector.

The securities that represent the equity sectors we monitor had the following Price Returns for the month of August 2025:

| IVV Price % Change (S&P 500) | +2.11% |

| IJH Price % Change (US Mid-Caps) | +3.38% |

| IWM Price % Change (US Small-Caps) | +7.19% |

| EFA Price % Change (Non-US Developed Markets) | +4.52% |

| EEM Price % Change (Emerging Markets) | +2.68% |

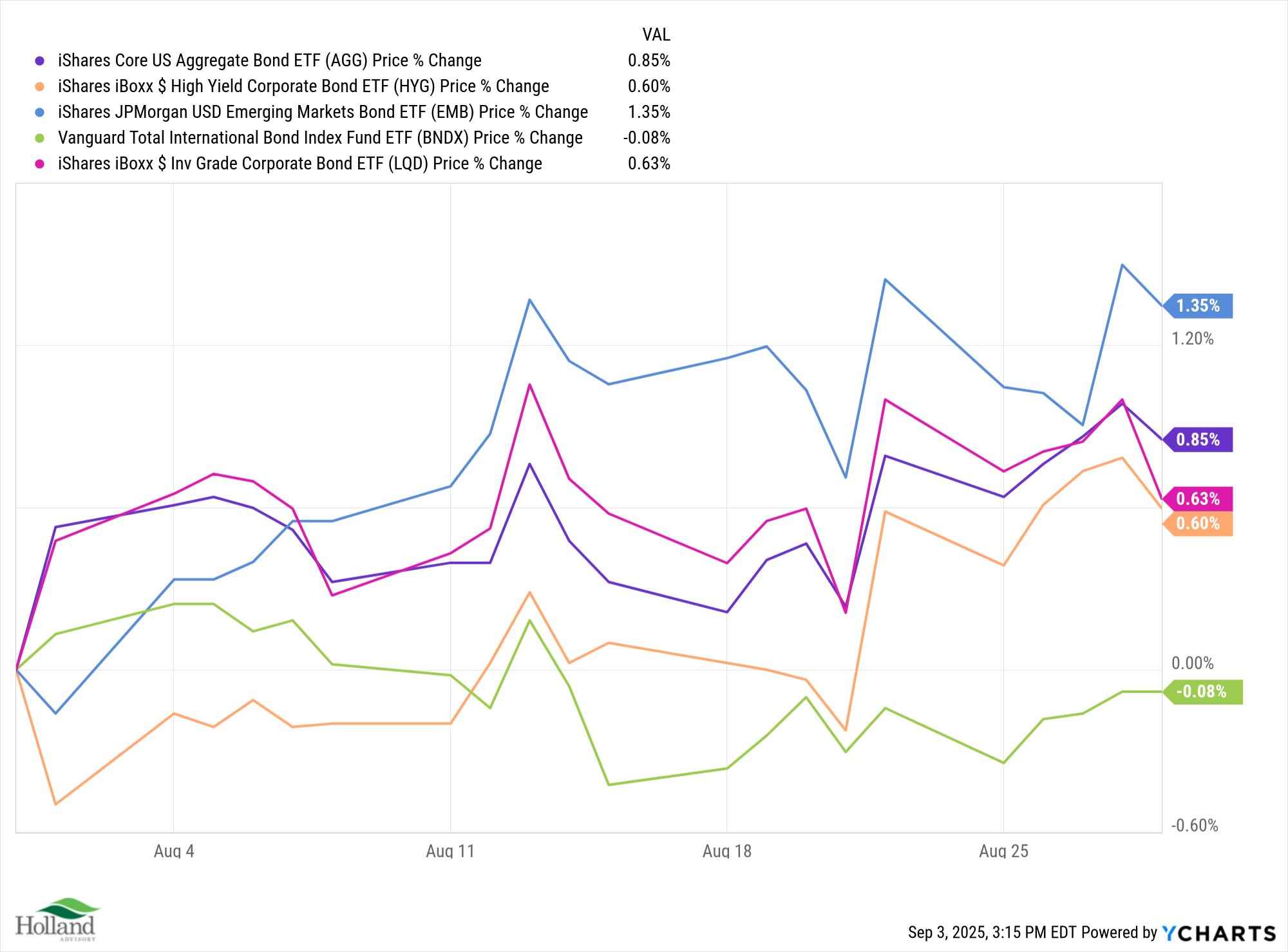

Fixed Income

With the exception of non-U.S. international fixed income, which dropped a miniscule 0.08%, all other bond sectors that we follow rose in price. The U.S. Aggregate Bond Index added 0.85%, while both investment-grade and high yield corporate issues inched approximately 0.60% into the green. Emerging market debt rose 1.35%. The Chairman of the Federal Reserve, Mr. Jerome Powell, and members of the Federal Open Market Committee (FOMC) are largely expected to cut interest rates by a quarter of one percent later in September, from an upper range of 4.50% to 4.25%. This would be welcome news for markets as borrowers will see lower financing costs. The housing sector may witness some, who are now on the sidelines, step into the market. The larger question remains: will consumers see only a single rate cut in 2025, or the two or three that the CME Group’s FedWatch Tool currently anticipates as of this writing?

The securities that represent the fixed income (bond) sectors we monitor had the following price returns for the month of August 2025:

| AGG iShares Core U.S. Aggregate Bond ETF | +0.85% |

| HYG iShares iBoxx High Yield Bond ETF | +0.60% |

| EMB JP Morgan USD Emerging Markets Bond ETF | +1.35% |

| BNDX Vanguard Total International Bond ETF | -0.08% |

| LQD iShares iBoxx Investment-Grade Bond ETF | +0.63% |